abr.gov.au Apply for Tax File Number for Business : Australian Registrar

Name of the Organization :Australian Business Registrar

Type of Facility : Apply for a TFN Tax File Number for business

Country : Australia

Website : https://abr.gov.au/For-Business,-Super-funds—Charities/Applying-for-other-registrations/Apply-for-a-TFN-for-business/

| Want to comment on this post? Go to bottom of this page. |

|---|

Apply for a TFN for business

Companies, trusts, partnerships, deceased estates and many other organisations can apply for a tax file number (TFN) online. Most businesses or organisations can apply for a TFN while completing their ABN application.

Related : Australia Post National Police Checks

Depending on your circumstances, provide the following information to help your application get processed faster:

** tax agent registration number

** Australian Company Number (ACN) or Australian Registered Body Number (ARBN)

** business locations

** authorised contacts

** associate’s details – including name, date of birth and TFN. If an associated individual chooses not to provide their TFN, you will be asked to provide their residential address

** business activity.

Application Form

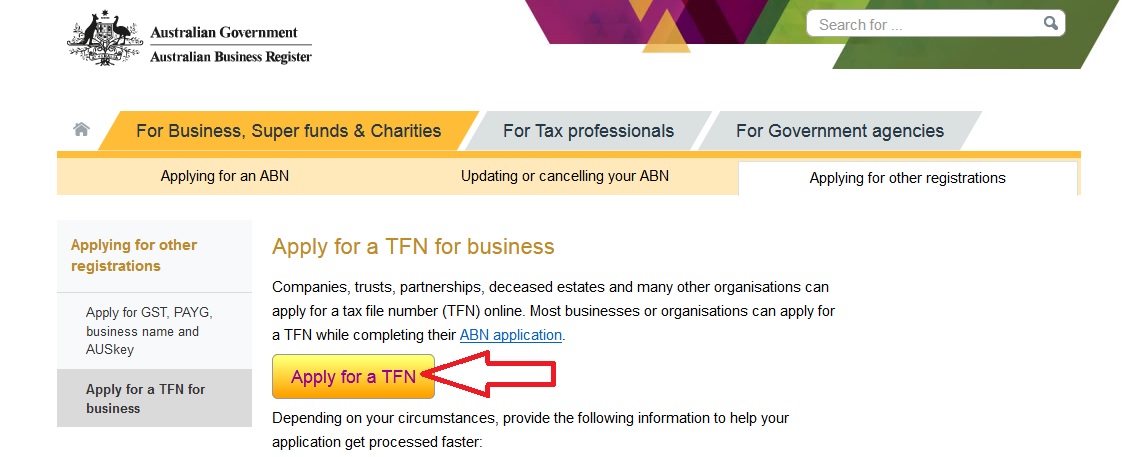

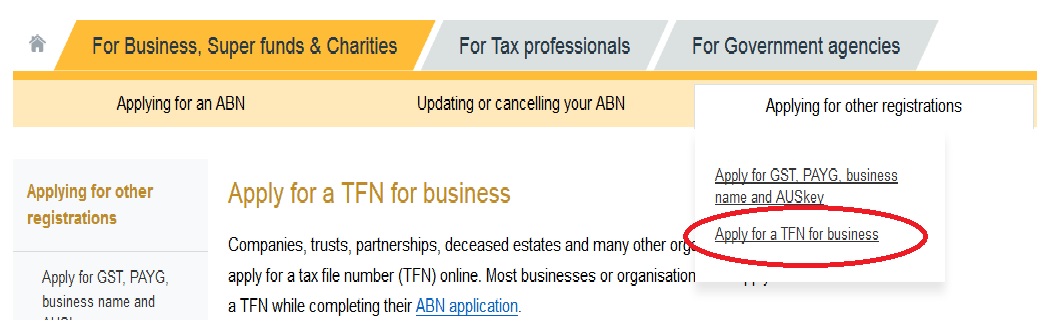

Go to the official website,click on the other service regurgitation tab in home page.then select the Apply for tfn link in drop down list.

TFN page will be displayed,click on Apply for TFN button.Application form will be opened,enter the required details to get an TFN Number.

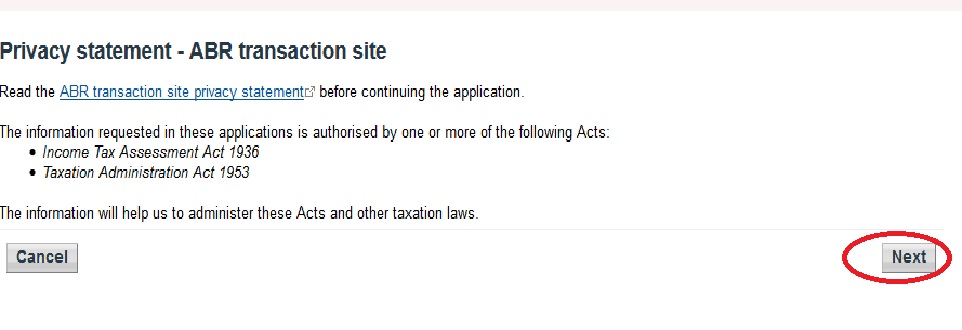

Read all the Privacy act statement,click on the next button.

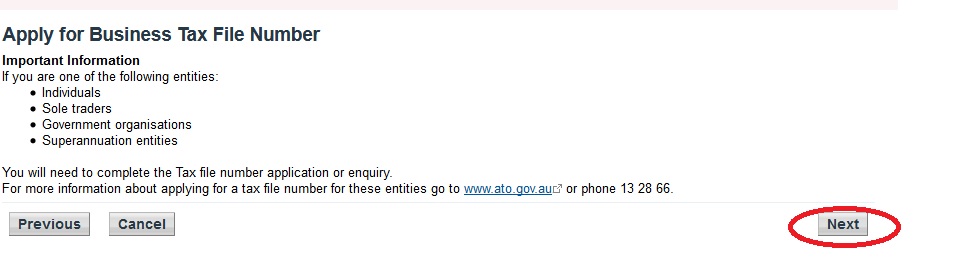

Then Read the tax file number position.click on next button.

Business Information Number :

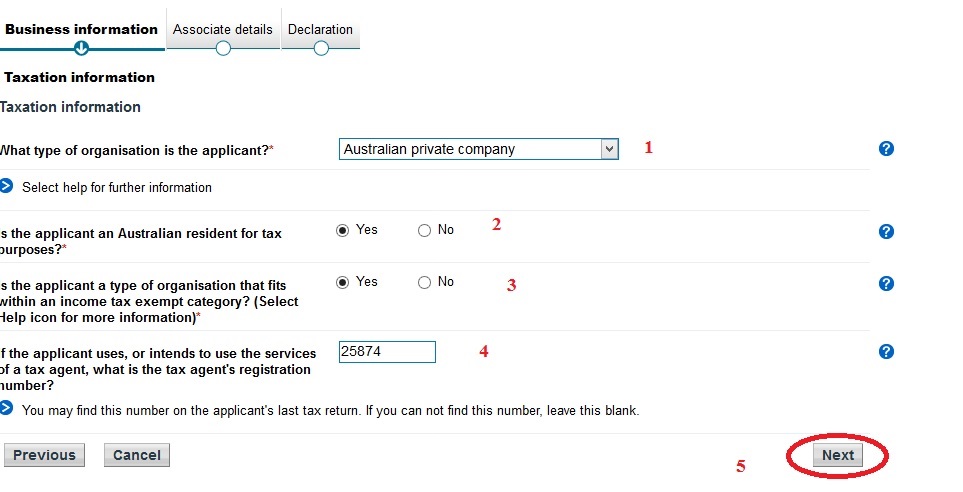

Taxation information

1. What type of organisation is the applicant?*

2. Select help for further information

3. Select Is the applicant an Australian resident for tax purposes?* Yes/No

4. Select Is the applicant a type of organisation that fits within an income tax exempt category? (Select Help icon for more information)* Yes/No

5. If the applicant uses, or intends to use the services of a tax agent, what is the tax agent’s registration number? yes/no

6. You may find this number on the applicant’s last tax return. If you can not find this number, leave this blank.

Click on Next button. Then fill the associate details and declaration section to complete the application form.

Lost or stolen TFN

If you can’t find your TFN you can :

** phone us on 13 28 61 between 8.00am and 6.00pm Monday to Friday. You can also phone Saturday between 10.00am to 4.00pm from 1 July to 31 October.

** Log in to your myGov account to locate your TFN.

If you think your TFN has been stolen :

** If your TFN has been lost, stolen or accessed by an unauthorised third party, tell us as soon as possible. We may apply security measures that will monitor for any unusual or suspicious activity on your account.

Next step :

** If your TFN has been stolen or you suspect misuse, phone our Client Identity Support Centre on 1800 467 033 between 8.00am and 6.00pm, Monday to Friday.

Client Identity Support Centre :

** The Client Identity Support Centre is a support service for taxpayers who have had their identities stolen or misused. We’ll give you information, advice and assistance to re-establish your identity.

Who can’t apply online

** If you are a super fund or a first home saver accounts trust, you cannot apply online.

** Individuals/sole traders cannot apply for a TFN for business.

** However they can apply for an individual TFN with the ATO.