OLT Check Status of Income Tax Refunds USA : On-Line Taxes

Organization : On-Line Taxes OLT

Service Name : Check Status of Your Income Tax Refunds

Country : United States of America

Website : https://www.olt.com/main/home/checkstatus.asp#

| Want to comment on this post? Go to bottom of this page. |

|---|

Check Status of Your Income Tax Refunds

On-Line Taxes can assist you with the status of your tax return, however we do not know the status of your refund from the IRS or your State.

Related :

Kentucky Department of Revenue Income Tax Refund Status USA

** Once you submit your return with OnLine Taxes, you will need to check your status in 24-48 hours to ensure acceptance.

** Once your Federal and/or State return has been accepted you will be able to check your status with the IRS or State once they have processed your return.

Federal Tax Refunds

You may also call 1-800-829-4477 to check on the status of your federal income tax refund.

In order to find out your expected refund date, you must have the following information :

** The primary Social Security Number on the return

** The filing status used on the return

** The whole dollar amount of the refund

If you need assistance with your filing status or the refund amount, Customer Service can assist you with obtaining that information if you filed using our service.

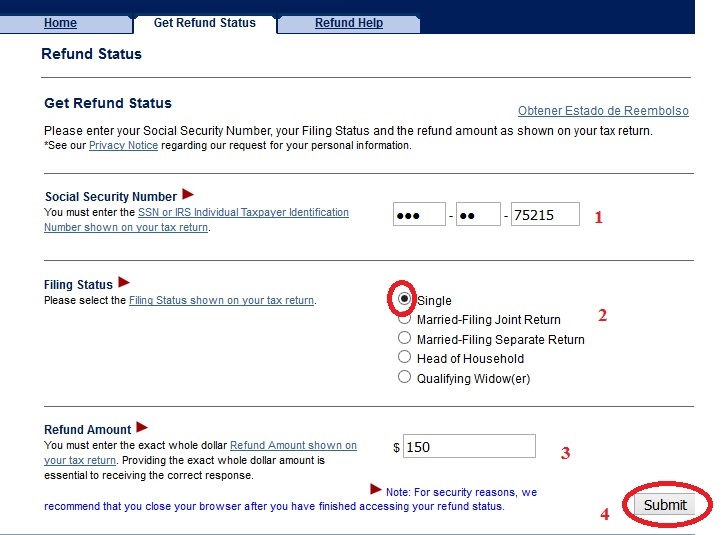

Get Refund Status :

1. Please enter your Social Security Number

2. Select your Filing Status

3. Enter the refund amount as shown on your tax return.

4. Click on submit button.

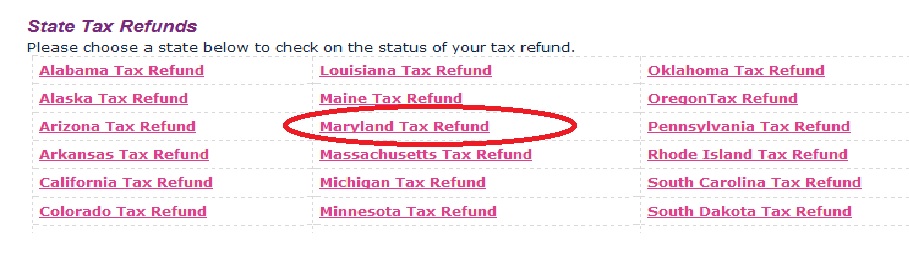

State Tax Refunds

Please choose a state below to check on the status of your tax refund.

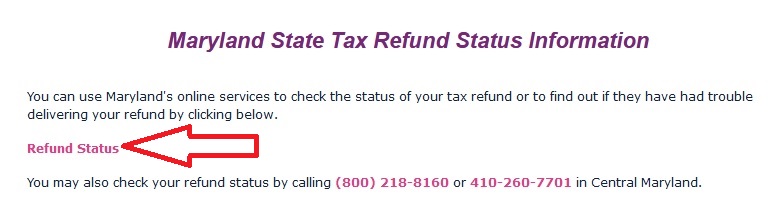

Maryland State Tax Refund Status Information :

You can use Maryland’s online services to check the status of your tax refund or to find out if they have had trouble delivering your refund by clicking below.

Refund Status :

Want To Check On Your Current Year Refund?

** You can check on the status of your current year Maryland income tax refund by providing your Social Security number and the exact amount of your refund as shown on the tax return you submitted.

** If you filed a joint return, please enter the first Social Security number shown on your return.

** In the refund box below, enter the exact amount of refund you requested, including dollars and cents.

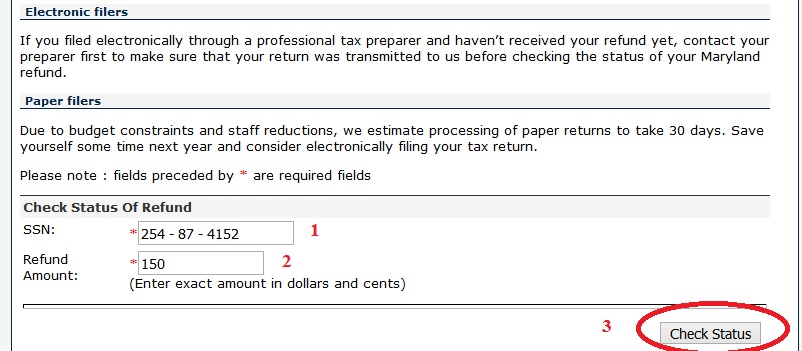

Check Status Of Refund :

Enter SSN Number *

Enter Refund Amount

Click on Check status button.

You may also check your refund status by calling (800) 218-8160 or 410-260-7701 in Central Maryland.

Check My e-file Status

Login To Online Taxes :

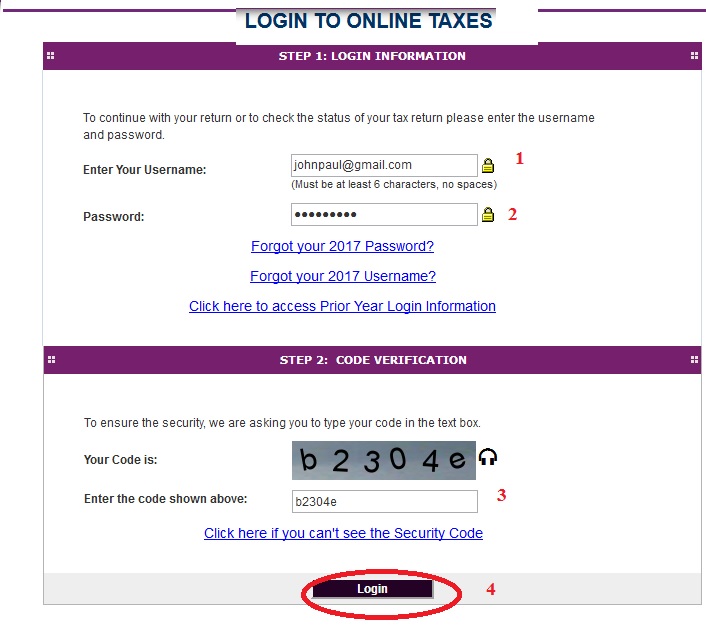

Step 1: Login Information

To continue with your return or to check the status of your tax return please enter the username and password.

Enter Your Username(Must be at least 6 characters, no spaces)

Enter Your Password

Step 2 : Code Verification

To ensure the security, we are asking you to type your code in the text box.

Enter the code shown above

Click on Login button.

Refund Status FAQ

Where do I get the Social Security Number or IRS Individual Taxpayer Identification Number?

Answer:

** If you filed a Form 1040, the Social Security Number is shown on Page 1 in the upper right hand corner.

** If you filed a Form 1040A, the Social Security Number is shown on Page 1 in the upper right hand corner.

** If you filed a Form 1040EZ, the Social Security Number is shown on Page 1 in the upper right hand corner.

Where do I get the Filing Status?

Answer:

** If you filed a Form 1040, the Filing Status is shown on Page 1, Boxes 1 through 5.

** If you filed a Form 1040A, the Filing Status is shown on Page 1, Boxes 1 through 5.

** If you filed a Form 1040EZ, the Filing Status is either Single or Married Filing a Joint Return.

Where do I get the Refund Amount?

Answer:

** If you filed a Form 1040, the Refund Amount is shown on Line 76a.

** If you filed a Form 1040A, the Refund Amount is shown on Line 48a.

** If you filed a Form 1040EZ, the Refund Amount is shown on Line 13a.

How long should I wait to check for my refund status?

Answer:

Please wait 24 hours after you e-file. If you filed on paper, please allow 4 weeks before checking on the status of your refund.

What can I do to get my refund issued ASAP?

Answer:

The quickest way to have your return processed and your refund issued is to file electronically. Your wait time will be cut in half – from six weeks to three.