ato.gov.au Check The Progress Of Your Tax Return : Australian Taxation Office

Organisation : Australian Taxation Office (ATO)

Facility Name : Check The Progress Of Your Tax Return

Country : Australia

Website : https://www.ato.gov.au/Individuals/Your-tax-return/Check-the-progress-of-your-tax-return/

| Want to comment on this post? Go to bottom of this page. |

|---|

What is ATO Progress Of Your Tax Return?

The ATO has received your return and has started processing it, or they have finalised your tax return and are issuing a notice of assessment. You can access an estimated assessment issue date. In progress – Information pending. The ATO is manually reviewing the tax return to make sure everything is right before it finalises it. This may include reviewing prior-year returns. It will contact the taxpayer if it needs more information.

How To Check The Progress Of Your Tax Return?

To Check The Progress Of Your Tax Return, the procedure are given below

The quickest and easiest way to check the progress of your tax return is by using our self-help services. Online returns process in 2 weeks (14 days) while paper takes up to 10 weeks (50 business days). Paper returns can take up to 7 weeks to show in our systems.

If your tax return requires manual checks processing it may take longer.

You can check the progress:

** online using ATO online services

** using the ATO app

** by phone

** with your registered tax agent

Once your tax return processes, we’ll issue a notice of assessment that will show:

** tax you owe on your taxable income

** credit you have for tax already paid during the income year

** tax amounts you need to pay or will receive as a refund.

1. Check online using ATO online services

If you link your myGov account to the ATO you can check the progress of your tax return or amendments using ATO online services.

To check the progress of your tax return:

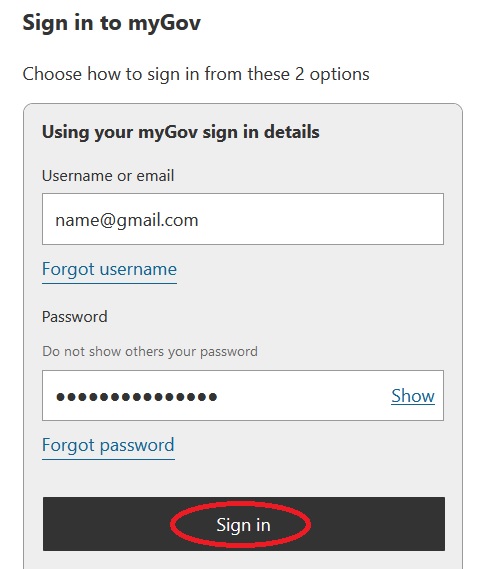

** sign in to myGovExternal Link

** select ATO from your member services

** from the home page select Manage tax returns

** then select the income year you are checking.

The status shows how your tax return is progressing.

If you don’t have a myGov account, it’s easy to create an account and link it to the ATO.

Link : https://www.ato.gov.au/

2. Check the progress in the ATO app

To check the progress of your 2021-22 tax return in the ATO app:

** login to the ATO app

** select Your tax return for 2021–22.

The status will be displayed on the screen within the ATO app. Use the help function for more information by selecting ‘?’ from the top right-hand side of the screen in the app.

3. Check by phone

Use our self-help phone service at any time:

** phone 13 28 65 and have your tax file number ready

** choose option 1 and then option 1.

4. Check with your registered tax agent

If you lodge with a registered tax agent, you or your agent can check the progress of your tax return anytime by signing in to ATO online services through myGov or the ATO app.

Status Of Your Tax Return

When you check the progress of your tax return using our online services, you might see one of these statuses (not all tax returns will display all of these),

** In progress – Processing

You may see this status at two stages of processing:

** we have received your tax return and we’ve started processing it

** we have finalised your tax return and are issuing a notice of assessment (you will see an estimated assessment issue date by clicking the down arrow).

** In progress – Information pending

** We are collecting information to help us finish processing your tax return. We will contact you if we need more information.

** In progress – Under review

** We are manually reviewing your tax return to make sure everything is right before we finalise it. This may include reviewing your prior year returns. We will contact you if we need more information.

** In progress – Balancing account

** We are balancing the result of your tax return with your accounts with us and other Australian Government agencies and calculating the amount we will refund or you need to pay. We will contact you if we need more information.

** Extra processing time is required

** We need more time to finish processing your tax return. We will contact you if we need more information.

** Issued – $ Amount

** You’ll be able to see your notice of assessment online, along with the date for payment and if you’re entitled to a refund.

If you provide valid Australian bank account details to us when you lodge, we will pay your refund directly into the bank account you nominate.

Email & SMS Communications

We may send you an email or SMS (text message) to let you know:

** if your tax return or refund has been delayed and why

** when your refund is on its way.

** Our messages will never ask you to reply by SMS or email to provide personal information, such as your tax file number (TFN).

** Why there may be a delay in processing your tax return

Although most tax returns lodged online will be processed in 2 weeks, some tax returns may take longer to process.

For example, if:

** you attempt to lodge your tax return again after previously lodging

** you have made an amendment before we finish processing your original tax return or any previous amendments

** you lodge tax returns for several years at once

** you are under an insolvency administration – for example bankruptcy or debt arrangement (check to make sure your insolvency practitioner advises us of your situation before you lodge your tax return)

** the Australian financial institution account details you included in your tax return are not current

** we need to check information in your tax return – we may need to contact your employer, financial institutions, private health insurers or you to confirm or cross-check information in your tax return

** we need to check information with other Australian Government agencies, for example, Services Australia, including Centrelink or Child Support – we’re required to pay part or all of your tax refund to other agencies if there are outstanding amounts (you will be notified if this was the case)

** you have a tax debt or previously unresolved tax debt with us

** you have a tax debt that was previously put on hold (also known as a re-raised or non-pursed debt).

If your tax return is delayed, you do not need to contact us. We will contact you if we need more information and will keep you or your agent informed of any ongoing delays.

If you think your circumstances put you under serious financial hardship review your eligibility to request priority processing.

Before You Prepare Your Tax Return

Reasons you need to lodge:

Each income year you need assess your personal circumstances to Work out if you need to lodge a tax return.

Reasons you need to lodge a tax return may include if you:

** had any tax taken out (withheld) from income you receive

** had $1 or more of foreign income

** are a liable or recipient parent under a child support assessment

** had business or investment income

** are leaving Australia and have a study or training support loan.

Information you need to lodge:

Before you lodge, find out What’s new for individuals this tax time.

To lodge your tax return, we recommend you have all of the following information available.

You will need your:

** bank account details (BSB and account number)

** income statement or payment summaries from all of your employers

** payment summaries from Centrelink (Services Australia)

** receipts or statements for the expenses you are claiming as deductions

** your spouse’s income (if you have one)

** private health insurance information (if you have cover).