fairwork.gov.au Pay Slips & Record-Keeping Australia : Fair Work Ombudsman

Organisation : Fair Work Ombudsman

Facility Name : Pay Slips & Record-Keeping

Country : Australia

Website : https://www.fairwork.gov.au/pay/pay-slips-and-record-keeping

| Want to comment on this post? Go to bottom of this page. |

|---|

Pay Slips & Record-Keeping

In any business, large or small, record-keeping is vital to success. Record-keeping and pay slip obligations ensure employees receive correct wages and entitlements.

Related / Similar Post :

Australian Registrar Apply for Tax File Number for Business

Pay slips

** Pay slips ensure that employees receive the correct pay and entitlements and allow employers to keep accurate and complete records.

When are pay slips given?

Pay slips have to be given to an employee within 1 working day of pay day, even if an employee is on leave.

How are pay slips given?

Pay slips have to be in either electronic form or hard copy. Electronic pay slips must have the same information as paper pay slips.

Requests for pay slips?

** If as an employee, you don’t receive a pay slip, we encourage you to talk to your employer.

** Check out our online learning course on having difficult conversations for tips on how to approach your employer.

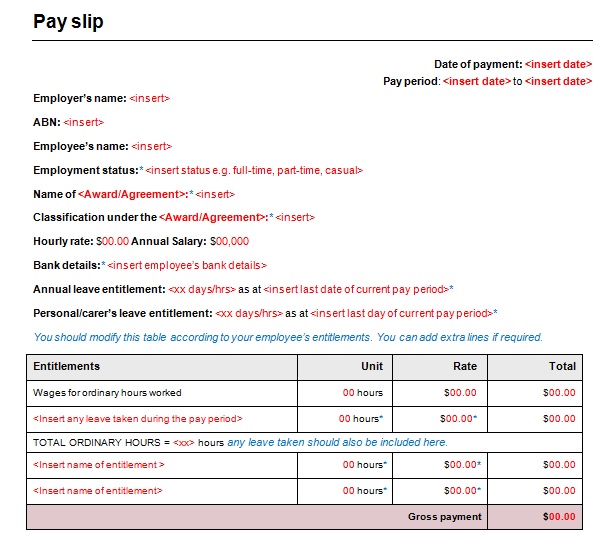

Check out the pay slips page to learn what has to be included on pay slips and find our pay slip template.

What has to be on a pay slip?

Pay slips have to cover details of an employee’s pay for each pay period. Below is a list of what to include:

** employer’s and employee’s name

** employer’s Australian Business Number (if applicable)

** pay period

** date of payment

** gross and net pay

Record-Keeping

Employers have to keep time and wages records for 7 years.

Time and wages records have to be :

** readily accessible to a Fair Work Inspector (FWI)

** legible

** in English.

General :

** employer’s and employee’s name

** employer’s ABN (if any)

** employee’s commencement date

** whether the employee is full-time, part time, or casual

** whether the employee is permanent or temporary.

Pay :

** pay rate paid to the employee

** gross and net amounts paid

** any deductions from the gross amount

** details of any incentive-based payment, bonus, loading, penalty rate, or other monetary allowance or separately identifiable entitlement paid.