revenue.ky.gov Income Tax Refund Status USA : Kentucky Department of Revenue

Organization : Kentucky Department of Revenue

Service Name : Check Income Tax Refund Status

City/State/Province : Kentucky

Country : United States of America (USA)

Website : https://revenue.ky.gov/Pages/index.aspx

| Want to comment on this post? Go to bottom of this page. |

|---|

Revenue Income Tax Refund Status

The Department of Revenue takes identity fraud very seriously. If any of your information (address, bank account, etc.) changed since last year, there may be additional security steps to verify your identity to protect you and the Commonwealth.

Related :

Chase Credit Card Online Application United States of America

Due to the dramatic increase in tax refund fraud, we have strengthened our fraud detection tools. Receiving your tax refund may take longer than in previous years. We appreciate your patience.

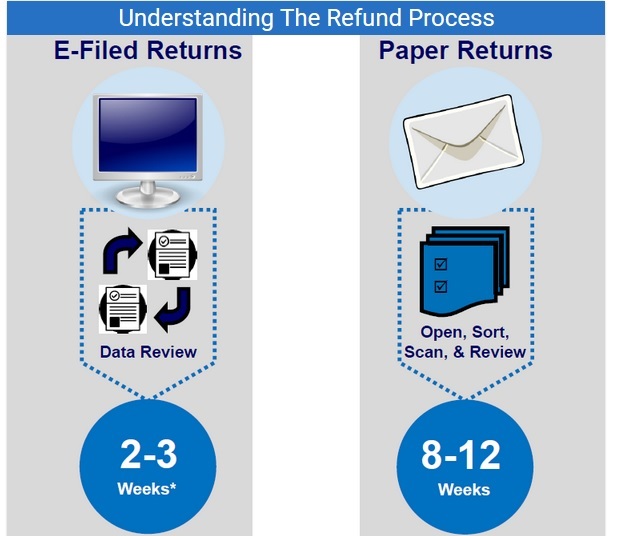

* Direct Deposit only. Allow an additional week for paper check requests.

Error correction will require additional time to process and may result in the issuance of a paper check in lieu of a direct deposit where applicable.

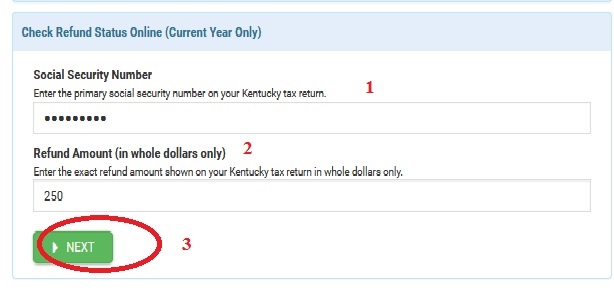

Check Refund Status Online

Enter the primary social security number on your Kentucky tax return.

Enter the exact refund amount shown on your Kentucky tax return in whole dollars only.

Processing Times

Typical processing times for current year Individual Income Tax returns with no errors.

** Electronic Filed Return (Same Year) – 2 to 3 weeks

** Paper Return (Same Year) – 8 to 12 Weeks

** Amended and Prior Years Returns – 150 to 180 Days

Report Tax Fraud

** The Kentucky Department of Revenue is dedicating significant resources to stop tax fraud.

** Please use the form below to report tax fraud to the Department of Revenue. You can report tax fraud anonymously, but reporting anonymously may limit the Department’s ability to obtain other needed information.

** Please be sure to include as much helpful information as possible, such as the subject’s address and date ranges of fraudulent activity.

** This can be very important in initiating a tax investigation.

** Confidential and personal information such as Social Security numbers, dates of birth or bank account numbers should not be transmitted via this online form.

** To include such information in tips about tax fraud, please contact the Division of Special Investigations via telephone at (502) 564-7118 or via postal mail at Division of Special Investigations, Kentucky Department of Revenue, 501 High Street, Station 18, Frankfort, KY 40601.

Contact Address

Kentucky Department of Revenue

Excise Tax Section

Station 62

PO Box 1303

Frankfort KY 40602-1303

04-19-2021 Checked ky tax refund shows refund deposit to bank on 03-19-21

deposit not in my account,