Apply for Canada Pension Plan

Organization : Government of Canada

Facility : Apply for Canada Pension Plan

Country : Canada

Website : https://www.canada.ca/en/services/benefits/publicpensions/cpp.html

| Want to comment on this post? Go to bottom of this page. |

|---|

Apply for Canada Pension Plan

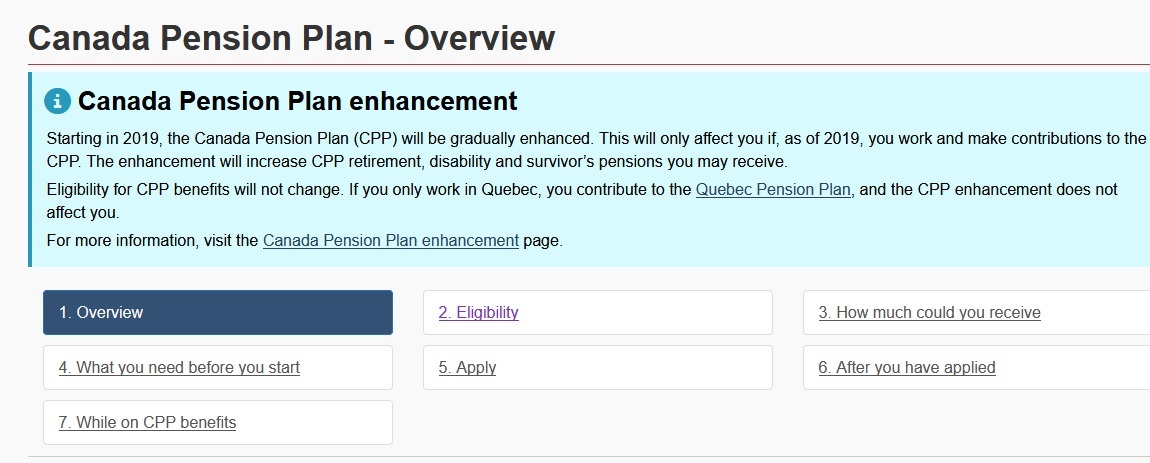

Starting in 2019, the Canada Pension Plan (CPP) will be gradually enhanced. Eligibility for CPP benefits will not change. If you only work in Quebec, you contribute to the Quebec Pension Plan, and the CPP enhancement does not affect you.

Related :

Access to Information & Privacy (ATIP) Online Request Canada

Overview

** The Canada Pension Plan (CPP) provides contributors and their families with partial replacement of earnings in the case of retirement, disability or death.

** Almost all individuals who work in Canada outside Quebec contribute to the CPP

** If you have lived or are living outside Canada, you may qualify for a pension from that country as well.

** If you have contributed to both the CPP and QPP, you must apply for the QPP if you live in Quebec or for the CPP if you live elsewhere in Canada.

** Please note that you do not have to apply to both plans.

Eligibility details

** The Canada Pension Plan (CPP) retirement pension provides a monthly benefit to eligible applicants.

** You can apply for and receive a full CPP retirement pension at age 65 or receive it as early as age 60 with a reduction, or as late as age 70 with an increase.

** Your CPP retirement pension does not start automatically. You must apply for it.

Before you apply, you must:

** be at least a month past your 59th birthday;

** have worked in Canada and made at least one valid contribution to the CPP; and

** want your CPP retirement pension payments to begin within 12 months.

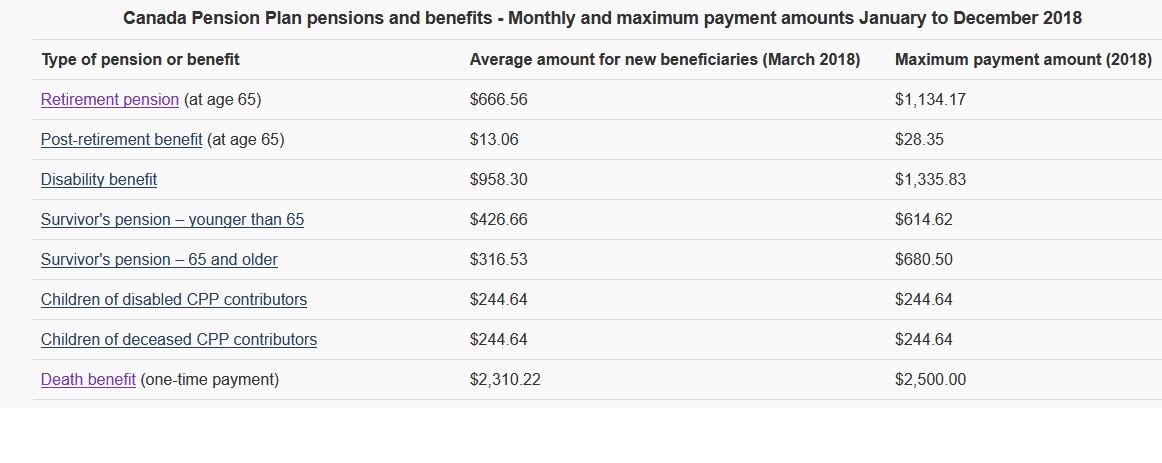

How much could you receive

** The amount of your Canada Pension Plan (CPP) retirement pension is based on how much you have contributed and how long you have been making contributions to the CPP at the time you become eligible.

** A certain number of your months with lowest earnings may be automatically dropped from the CPP retirement pension calculation under the general drop-out provision. This may help increase the amount you will receive.

How your age will affect your monthly payment :

** The standard age for beginning to receive your CPP retirement pension is the month after your 65th birthday.

** However, you can take a reduced pension as early as age 60 or begin receiving an increased pension after age 65.

Canada Pension Plan payment amounts

When you apply online for your CPP retirement pension, you must confirm your personal information and provide :

** your banking information to sign up for direct deposit; and

** the date you would like your pension to start;

** You can apply a maximum of 12 months before the date you would like your pension to start.

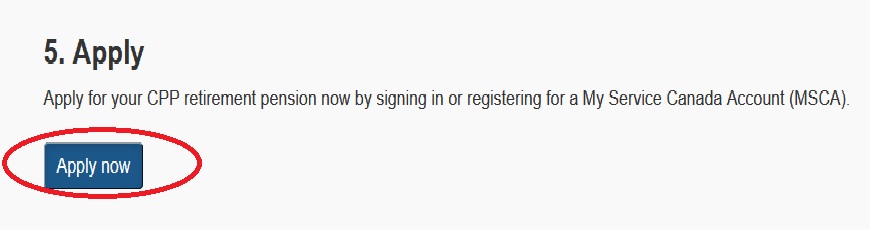

Apply Online

Apply for your CPP retirement pension now by signing in or registering for a My Service Canada Account (MSCA).Click on the apply now button.

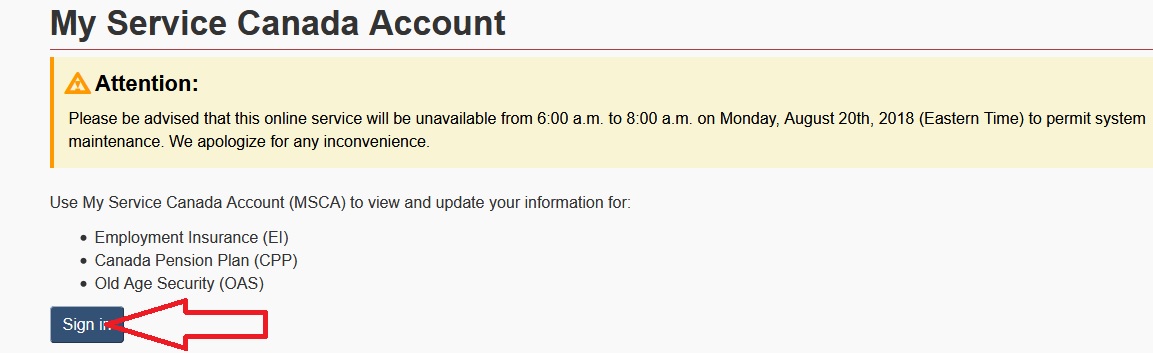

My Service Canada Account :

Use My Service Canada Account (MSCA) to view and update your information for:

** Employment Insurance (EI)

** Canada Pension Plan (CPP)

** Old Age Security (OAS)

Click on sign in button.

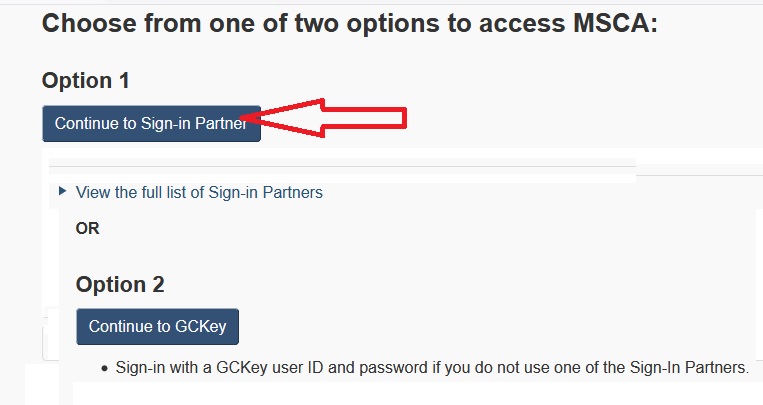

Then Choose from one of two options to access MSCA :

Option 1 or Option 2

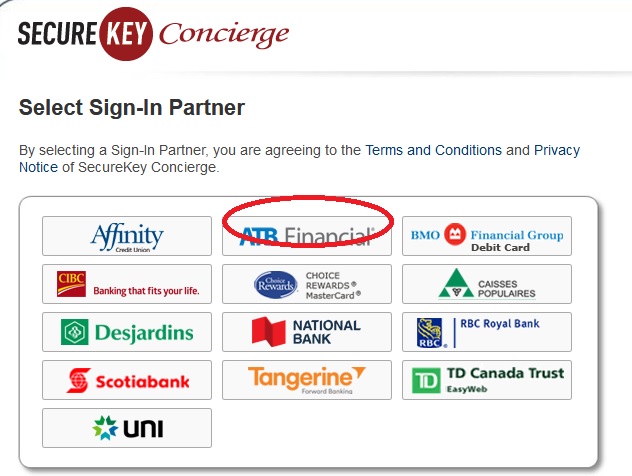

Continue to sign-in partner

** Use the same sign-in information you use for other online services

** If you have a joint bank account, only one of the two people can register for MSCA with the shared account.

** The second person must use a different Sign-In Partner account or create a GCKey account.

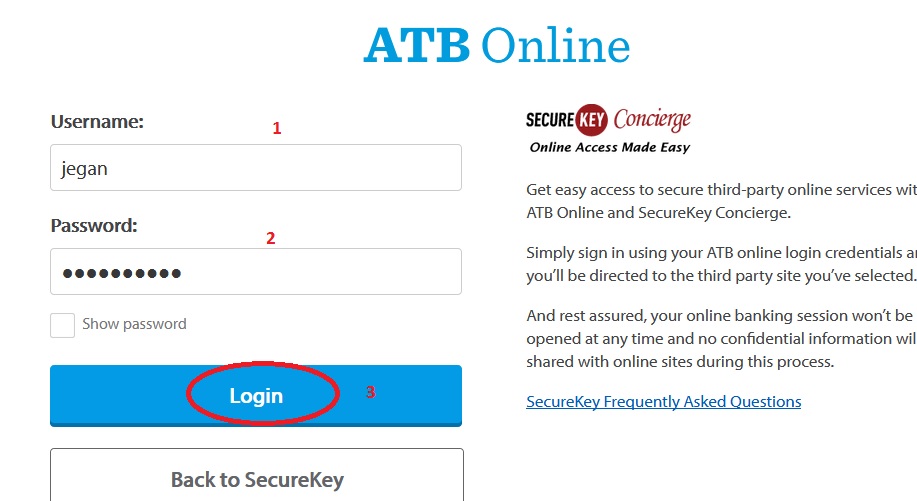

ATB Financial Online:

1. Enter User Name

2. Enter Password

3. Click on login button.

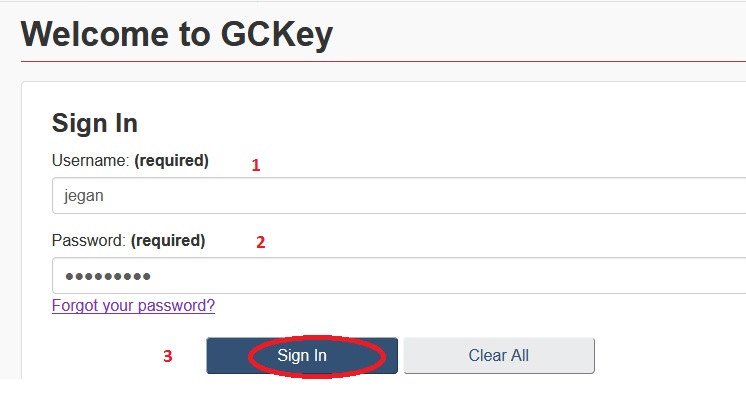

Continue to GCkey

** Sign-in with a GCKey user ID and password if you do not use one of the Sign-In Partners.

** Register for a GCKey user ID and password if you do not have one.

** Your GCKey user ID can be used to access other Government of Canada departments and agencies.

Steps :

1. Enter User Name

2. Enter Password

3. Click on Sign in button.

You will not be able to apply online if :

** you are currently receiving a CPP retirement pension;

** you have already applied for the CPP retirement pension and Service Canada is currently assessing your application;

** you are currently or were previously receiving a CPP disability benefit;

** you previously received a disabled contributor’s child benefit or a surviving child’s benefit;

** you were previously receiving a benefit that was paid to a designated third party;

** you currently live outside of Canada; or

** you have an authorized third party on your account.

If any of the above applies to you, you will need to complete the Application for a Canada Pension Plan Retirement Pension and include certified true copies of the required documentation, and mail it or bring it to the Service Canada Centre closest to you. Mailing addresses are provided on the form.

After you’ve applied

Upon completion of your application, you can choose to apply for various other CPP benefits and provisions, including :

Pension sharing: You may be eligible to share your CPP retirement pension with your spouse or common-law partner.

Credit splitting: The CPP contributions you and your spouse or common-law partner made during the time you lived together can be equally divided after a divorce or separation.

Child-rearing provision: You may be eligible to increase your CPP retirement pension if you had zero or low earnings because you were the primary caregiver raising your children.

While on CPP benefits

** What you need to know while receiving Canada Pension Plan benefits

** Once you are receiving Canada Pension Plan (CPP) pensions and benefits, you need to know the following.

Payments :

See payment dates and payment amounts for CPP.

Direct deposit :

** With direct deposit, your CPP payments can be automatically deposited each month into your bank account. Direct deposit is available for accounts in Canada, the United States and many other countries.

** If you have not requested payment by direct deposit, you will usually receive your payment within the last 3 business days of each month.