irs.gov Apply for an EIN Online USA : Internal Revenue Service

Organization : Internal Revenue Service IRS

Service Name : Apply for an EIN Online

Country : United States of America

Website : https://www.irs.gov/businesses/small-businesses-self-employed/how-to-apply-for-an-ein

| Want to comment on this post? Go to bottom of this page. |

|---|

IRS Apply for an EIN Online

An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity.

Related :

Kentucky Department of Revenue Register Your Business USA

You may apply for an EIN in various ways, and now you may apply online. This is a free service offered by the Internal Revenue Service and you can get your EIN immediately.

Hours of Operation :

Monday to Friday, 7 a.m. to 10 p.m. Eastern Standard Time.

How to Apply for an EIN

If you are a home-care service recipient who has a previously assigned EIN either as a sole proprietor or as a household employer, do not apply for a new EIN. Apply for an various type as apply by fax, apply by online, apply by mail,apply by Telephone.

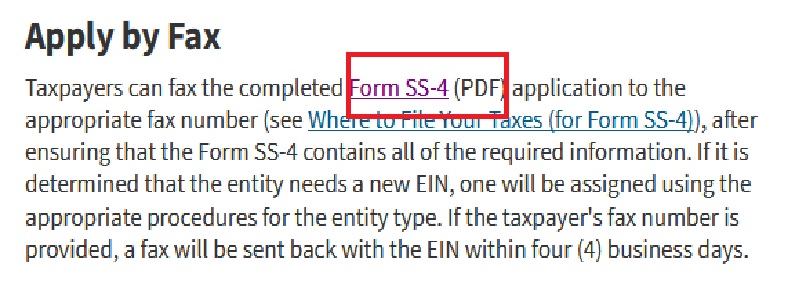

Apply by Fax

** Taxpayers can fax the completed Form SS-4 application to the appropriate fax number , after ensuring that the Form SS-4 contains all of the required information.

** If the taxpayer’s fax number is provided, a fax will be sent back with the EIN within four (4) business days.

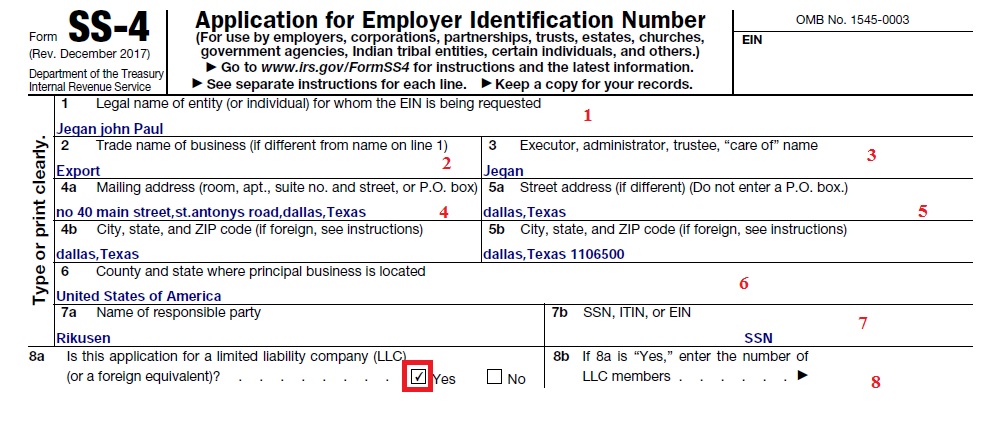

Application for Employer Identification Number :

1. Legal name of entity (or individual) for whom the EIN is being requested

2. Trade name of business (if different from name on line 1)

3. Executor, administrator, trustee, “care of” name

4a. Mailing address (room, apt., suite no. and street, or P.O. box)

5a. Street address (if different) (Do not enter a P.O. box.)

4b. City, state, and ZIP code (if foreign, see instructions)

5b. City, state, and ZIP code (if foreign, see instructions)

6. County and state where principal business is located

7a. Name of responsible party

8a. Is this application for a limited liability company (LLC) (or a foreign equivalent)? …….. Yes/No

8b. If 8a is “Yes,” enter the number of LLC members …… ?

8c. If 8a is “Yes,” was the LLC organized in the United States?………………

Apply Online

** The Internet EIN application is the preferred method for customers to apply for and obtain an EIN.

** Once the application is completed, the information is validated during the online session, and an EIN is issued immediately.

**

Step 1: Determine Your Eligibility

** You may apply for an EIN online if your principal business is located in the United States or U.S. Territories.

** The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN).

** You are limited to one EIN per responsible party per day.

Step 2 : Understand the Online Application

** You must complete this application in one session, as you will not be able to save and return at a later time.

** Your session will expire after 15 minutes of inactivity, and you will need to start over.

Step 3: Submit Your Application

** After all validations are done you will get your EIN immediately upon completion. You can then download, save, and print your EIN confirmation notice.

Apply by Mail

** The processing time frame for an EIN application received by mail is four weeks.

** Ensure that the Form SS-4 (PDF) contains all of the required information.

** If it is determined that the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type and mailed to the taxpayer.

Apply by Telephone

International Applicants :

** International applicants may call 267-941-1099 (not a toll-free number) 6:00 a.m. to 11:00 p.m. (Eastern Time) Monday through Friday to obtain their EIN.

** The person making the call must be authorized to receive the EIN and answer questions concerning the Form SS-4 (PDF), Application for Employer Identification Number.